Time series of assessment rates may also tell a story. Since rates are ultimately based on incurred costs, rising rates usually indicate rising costs within the sector covered by the premium or assessment. This holds true for most systems. For example, rates may rise if experience shows that injuries are resulting in increases in severity. Other explanations are also possible.

I recently resurrected some notes I had copied from Sir William R. Meredith’s Interim Report on Laws Relating to the Liability of Employers (1912). In that report is a table of Premium rates for employers in their industry ‘mutual funds’. As you may recall, the German system at the time consisted of employer mutual insurance funds for workers’ compensation organized by sector. Bismarck proposed the system in the early 1880s and the time series in Meredith’s interim report covers the period 1886 to 1908. Many of the rates changed over the time series. This is understandable because the first year would have been an estimate. Over time, as experience was gained, more accurate estimates of cost could be made. This would lead to more accurate premium rates.

Meredith notes that the German rates include a nine to ten percent margin above the cost rate to establish reserves funds to cover unforeseen contingencies such as “the entire wiping out of the industry or its inability to meet its payments in a period of financial depression”. There is a lesson there for many systems.

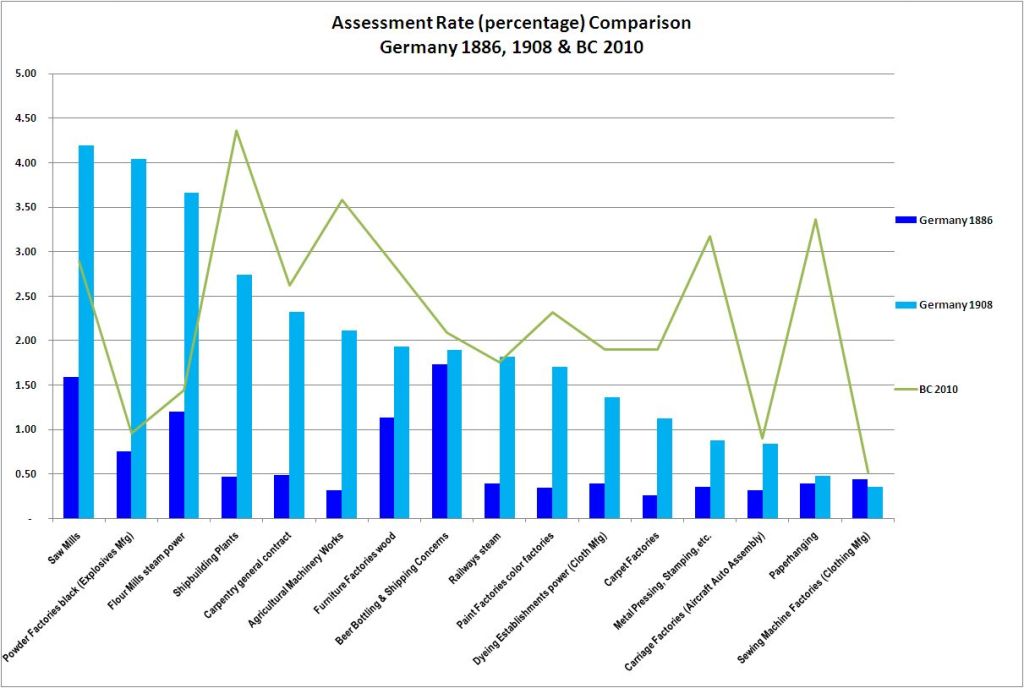

How much have things changed since then? The following chart lists the Assessment Rates for Germany for selected sectors in 1886 and 1908 (bars) with the current (2010) WorkSafeBC premium rates (points connected with a line).

Looking only at the German rates, one can see that most rates rose over the first two decades. By comparison, using our modern classifications with some adaptations (like substituting ‘Aircraft Automobile Assembly’ for ‘Carriage factories’), about half the rates are near or below their German counterparts’ 1908 levels. This is understandable with respect to some sectors such as sawmills where technology has made amazing progress in terms of safety and health. Other sectors have increased in costs. The explanations here might relate more to increases in scope of coverage (to include occupational diseases such as asbestos-related conditions in shipbuilding).

Comparing systems is always problematic and comparing different systems more than a hundred years apart is an admittedly dubious enterprise. It is natural, however, to ask how the rates of one system compare to another particularly at the industry level even if widely separated by time; most of us need that perspective as a starting point. What surprised me was that premiums today are not drastically different than they were a century ago. I don’t believe that the cost of workplace injuries should be considered merely a cost of production. That said, what is striking about the chart is how similar the range of rates appear.

No comments:

Post a Comment